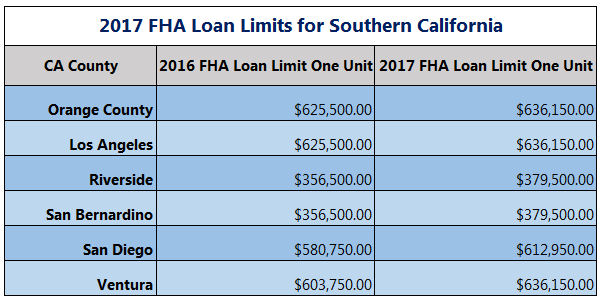

As you embark on your journey towards homeownership, you may be considering various loan options. One loan option available to you is the Federal Housing Administration (FHA) loan. FHA loans have been helping people become homeowners since 1934 and may be a great option for you if you are a first-time homebuyer or if you have a less-than-perfect credit score. If you are interested in applying for an FHA loan, there are certain requirements that you must meet. To help you better understand the FHA loan requirements for 2020, we have compiled some important information for you. The first requirement you must meet is the credit score. Unlike traditional loans, FHA loans allow for lower credit scores. However, you must have a minimum credit score of 580 to qualify for the 3.5% down payment option. If your credit score falls below 580, you may still be eligible for an FHA loan, but you will need to make a higher down payment, typically around 10%. In addition to credit score requirements, you must also have a steady income and employment history. Typically, lenders prefer to see at least two years of steady employment and income from the same source. This requirement ensures that you will be able to make your mortgage payments on time. Another important requirement is the debt-to-income ratio (DTI). Your DTI is a measure of how much debt you have compared to your income. To qualify for an FHA loan, you must have a DTI of 43% or less. Your DTI is calculated by dividing your monthly debt payments by your gross monthly income. When it comes to the property you are looking to purchase, there are also requirements that must be met. The property must be your primary residence and must be in good condition. It cannot be a fixer-upper or a property that requires extensive repairs. Additionally, the property must meet certain appraisal requirements. The appraisal is conducted by an FHA-approved appraiser and ensures that the property meets the minimum property standards set by the Department of Housing and Urban Development (HUD). The property must also be located in an approved area. Now that you have a general understanding of the FHA loan requirements for 2020, let's take a look at some specific details related to FHA loans. One important aspect to note is the loan limit. The loan limit is the maximum amount that you can borrow for an FHA loan. In most areas of the country, the 2020 loan limit for a single-family home is $331,760. However, in areas with high housing costs, the limit can go up to $765,600. Another benefit of FHA loans is the down payment requirement. As mentioned earlier, the minimum down payment required for an FHA loan is 3.5%. This is a much lower requirement compared to traditional loans which require a minimum of 20% down payment. This lower down payment requirement can make it easier for you to become a homeowner. FHA loans also offer flexibility when it comes to income sources. Lenders will consider various sources of income when determining your eligibility for a loan. This includes income from part-time jobs, bonuses, and even child support or alimony payments. In addition to the benefits mentioned above, FHA loans also offer fixed and adjustable interest rates, which can help you better manage your monthly payments. It's important to note that FHA loans do require mortgage insurance, which can increase your monthly payments. Now that you have a basic understanding of FHA loans, let's take a closer look at some of the images we have provided to further help you understand the requirements and benefits of FHA loans. Image 1: FHA Loan Requirements for 2020  As you can see from this image, the credit score requirement for an FHA loan is lower compared to traditional loans. However, it's important to note that a minimum credit score of 580 is required for the 3.5% down payment option. If your credit score falls below 580, you may still be eligible for an FHA loan, but you will need to make a higher down payment. In this image, you can also see the requirement for a steady income and employment history. Lenders prefer to see at least two years of steady employment and income from the same source to ensure that you will be able to make your mortgage payments on time. Image 2: FHA Loan Limit Goes up for 2017 in OC  This image highlights the loan limit increase for 2017 in Orange County, California. As mentioned earlier, the loan limit is the maximum amount that you can borrow for an FHA loan. In areas with high housing costs, the limit can go up to $765,600. This increase in loan limit can make it easier for homebuyers in high-cost areas to obtain an FHA loan. In summary, FHA loans may be a great option for you if you are a first-time homebuyer or if you have a less-than-perfect credit score. However, there are certain requirements that must be met, including a minimum credit score, a steady income and employment history, and a maximum debt-to-income ratio. The property you are looking to purchase must also meet certain requirements, including being in good condition and meeting certain appraisal standards. FHA loans offer various benefits, including lower down payment requirements, fixed and adjustable interest rates, and flexibility when it comes to income sources. Though mortgage insurance is required for FHA loans, the benefits may outweigh the costs. If you are interested in applying for an FHA loan, it's important to work with an experienced lender who can guide you through the process and ensure that you meet all the requirements.

If you are looking for FHA Loan Requirements in 2020 you've came to the right page. We have 7 Images about FHA Loan Requirements in 2020 like FHA Loan Limit Goes up for 2017 in OC | OC Home Buyer Loans, FHA loan limits to increase in most of U.S. in 2019 - HousingWire and also FHA Loan Limits for 2021 - Lookup by County - FHA Lenders. Here it is:

FHA Loan Requirements In 2020

toploanmortgage.com

toploanmortgage.com fha mortgage

FHA Loan Limit Goes Up For 2017 In OC | OC Home Buyer Loans

www.ochomebuyerloans.com

www.ochomebuyerloans.com loan fha county orange limits limit buyers mean does higher

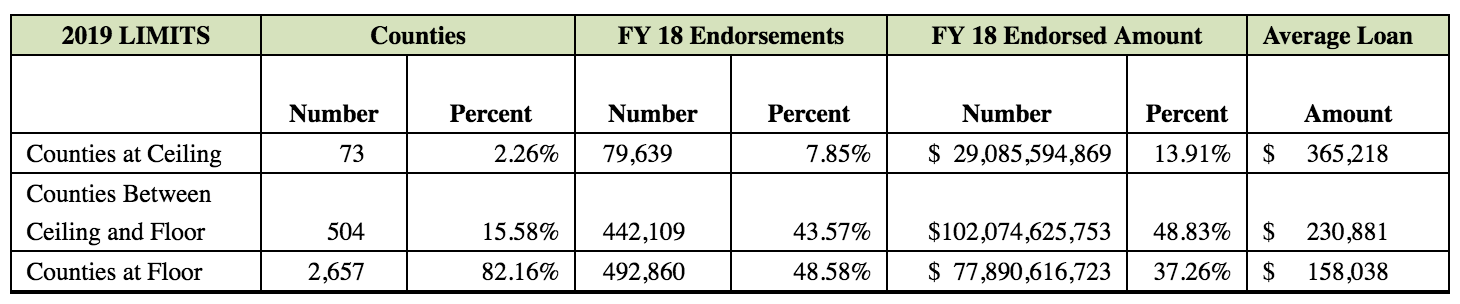

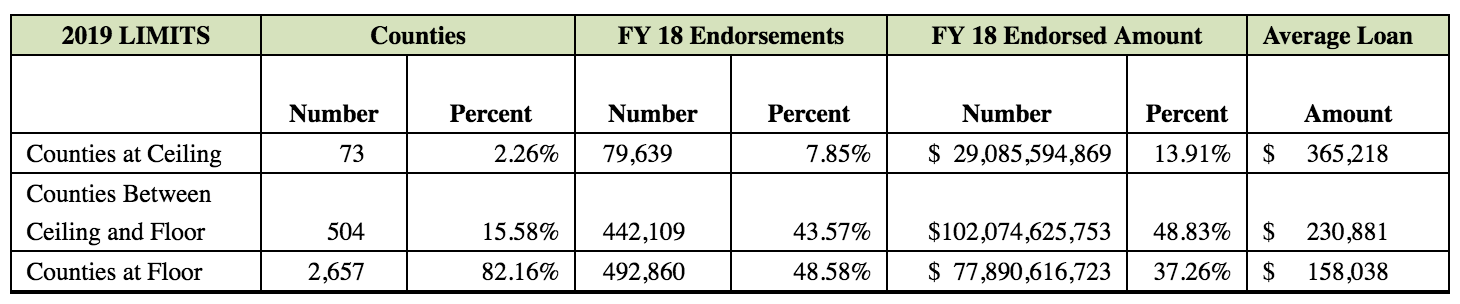

FHA Loan Limits To Increase In Most Of U.S. In 2019 - HousingWire

www.housingwire.com

www.housingwire.com loan limits fha mortgage increase most housingwire lending significantly maestro enlarge click counties housing

FHA Loan Limits By State And County (2020)

thewendythompsonteam.com

thewendythompsonteam.com fha limits loans homebuyers

FHA Mortgage Limits For Fairfield County, CT ~ 2015.

activerain.com

activerain.com fha limits mortgage chart connecticut fairfield ct county

FHA Loan Requirements For 2020 | NextAdvisor With TIME

time.com

time.com fha loan requirements getty limits

FHA Loan Limits For 2021 - Lookup By County - FHA Lenders

fhalenders.com

fhalenders.com fha loan lookup

Fha loan limits by state and county (2020). Fha loan lookup. Fha loan requirements getty limits

toploanmortgage.com

toploanmortgage.com  www.housingwire.com

www.housingwire.com  thewendythompsonteam.com

thewendythompsonteam.com  time.com

time.com  fhalenders.com

fhalenders.com

Post a Comment for "Fha Loan Limits Kootenai County"