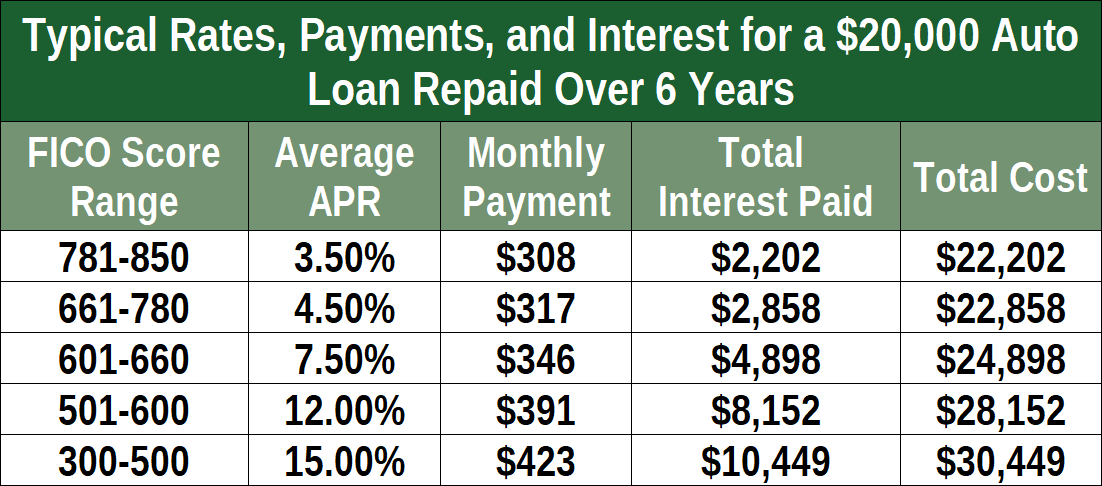

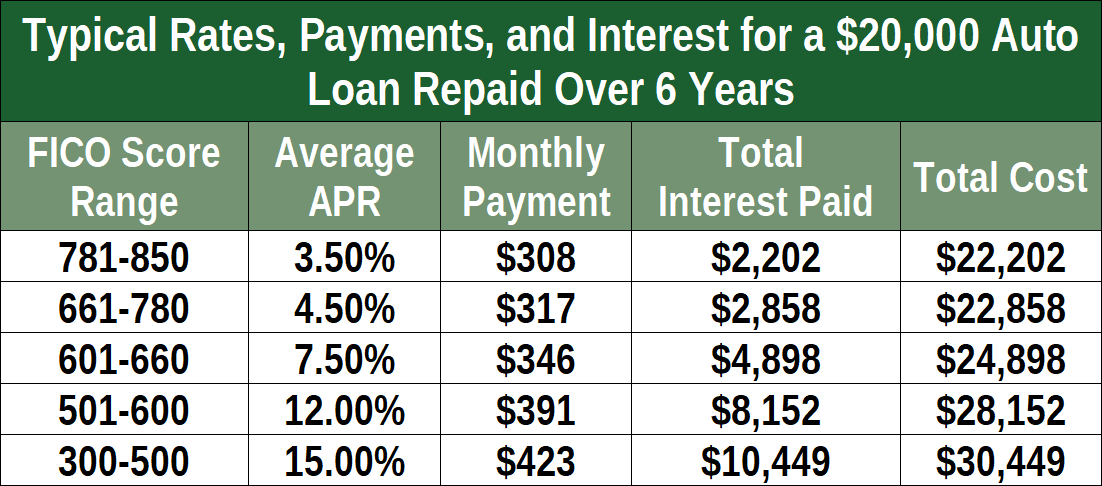

Are you thinking of buying a car in Utah? Well, it's essential to know the current auto loan rates before you go ahead and make a big financial decision. With that in mind, we've collected some data about the current auto loan rates in Utah to help you in your car-buying journey. The current auto loan rates in Utah vary depending on several factors, including credit score, loan term, and vehicle type. On average, the rates range from 2.49% to 4.27% for new cars, whereas used cars have slightly higher rates of 2.99% to 4.49%. If you have an excellent credit score, you may qualify for an even lower annual percentage rate (APR) of 0.99% to 2.49%. However, if your credit score is not that great, you may end up with a higher APR ranging from 3.74% to 12.99%. It's essential to keep in mind that the loan term also impacts the auto loan rates, with terms ranging from 36 months to 84 months. Shorter loan terms usually have lower interest rates, while longer terms result in higher interest rates. Now that you know the current auto loan rates let's dive into what it means to take on a car loan and how it can affect your finances. Taking on a car loan is a significant financial commitment and should not be taken lightly. When you take out a loan, you are borrowing money from a lender, which you must repay over time, with interest. That means the longer you take to pay off the loan, the more you will pay in interest. As such, it's essential to evaluate your budget and determine what you can realistically afford before taking out an auto loan. Consider all aspects of owning a car, including insurance, maintenance, and gas costs. If you've done your due diligence, have a solid budget in place, and are ready to take the plunge, then it's time to start shopping around for a car loan. But, before you start filling out applications, make sure you understand the different types of car loans that are available. There are two primary types of car loans: secured and unsecured. Secured loans use the car as collateral, meaning if you fail to make payments, the lender can seize the vehicle. Unsecured loans don't use collateral, meaning the lender has no asset to seize if you default on the loan. Additionally, there are two types of interest rates: fixed and variable. Fixed rates stay the same over the loan term, while variable rates fluctuate based on market conditions. Fixed rates offer more stability, while variable rates can be unpredictable. Now that you know the types of loans available let's take a closer look at each of the images included in this post. The first image shows the "Current Auto Loan Rates Utah." The h2 headline reads, "Auto Loan Rates in Utah: Terms, Rates, and Requirements." The image depicts a car dashboard with a keypad and the word "Approved" highlighted. The alt tag for this image reads, "Current Auto Loan Rates Utah." Under the image, there is a paragraph that reads, "Knowing the current auto loan rates in Utah can help you make a more informed decision when purchasing a car. Whether you're looking to buy a new or used car, your credit score, loan term, and vehicle type all play a role in determining the interest rate you'll receive. It's crucial to have a good understanding of your financial situation and your budget before taking on a car loan." The second image shows a couple sitting in a car, with the h2 headline reading "Compare Average Auto Loan Rates in 2021." The alt tag for this image reads, "Average Auto Loan Rates | Credit Repair." Under the image, the paragraph reads, "If you're in the market for a car loan, it's essential to compare rates from multiple lenders. The interest rate you receive can impact the total amount you pay for a car, so it's crucial to shop around. Keep in mind that your credit score, loan term, and vehicle type can all affect your interest rate." In conclusion, taking on an auto loan is a significant financial decision, and it's crucial to make an informed decision. By understanding the current auto loan rates in Utah, evaluating your budget, and shopping around for the best loan terms, you'll be able to make the best decision for your financial situation.

If you are looking for Compare Car Insurance: Compare Auto Financing Rates you've visit to the right place. We have 7 Pics about Compare Car Insurance: Compare Auto Financing Rates like Auto Loan Rates: Used, New, and Refinance | LendEDU, Car Loan Interest Rate For 600 Credit Score - Classic Car Walls and also Car Loan Interest Rate For 600 Credit Score - Classic Car Walls. Read more:

Compare Car Insurance: Compare Auto Financing Rates

comparecswa.blogspot.com

comparecswa.blogspot.com rates mortgage auto loan interest rate car year fixed usa projections gobankingrates forecast affect months mortgages compare going finance money

Auto Loan Rates: Used, New, And Refinance | LendEDU

lendedu.com

lendedu.com loan lendedu rates auto

Car Loan Interest Rate For 600 Credit Score - Classic Car Walls

classiccarwalls.blogspot.com

classiccarwalls.blogspot.com approval dealerships lots

Current Auto Loan Rates Utah

www.sappscarpetcare.com

www.sappscarpetcare.com rates current auto loan utah

Average Auto Loan Rates | Credit Repair

www.creditrepair.com

www.creditrepair.com loan credit rates auto car average score standards regarding disclosure editorial

What Does It All Mean | Phillips & Company

phillipsandco.com

phillipsandco.com auto loan defaults does default mean underlying complex meaning yet questions simple were they their phillipsandco

Car Loan Rates - 10 Best Auto Loan Rates (Guide For 2020)

epicsidegigs.com

epicsidegigs.com loan rates car guide auto

Auto loan defaults does default mean underlying complex meaning yet questions simple were they their phillipsandco. Current auto loan rates utah. Auto loan rates: used, new, and refinance

comparecswa.blogspot.com

comparecswa.blogspot.com  lendedu.com

lendedu.com  classiccarwalls.blogspot.com

classiccarwalls.blogspot.com  www.sappscarpetcare.com

www.sappscarpetcare.com  www.creditrepair.com

www.creditrepair.com  epicsidegigs.com

epicsidegigs.com

Post a Comment for "Gpo Auto Loan Rates"