If you’re in the market for a car loan but have a credit score of 600 or lower, the good news is that you still have options. The bad news? Your interest rate may not be as low as you’d like. But before you resign yourself to a high-interest loan, it’s worth shopping around to find the best possible rate.

Car Loan Interest Rates for a 600 Credit Score

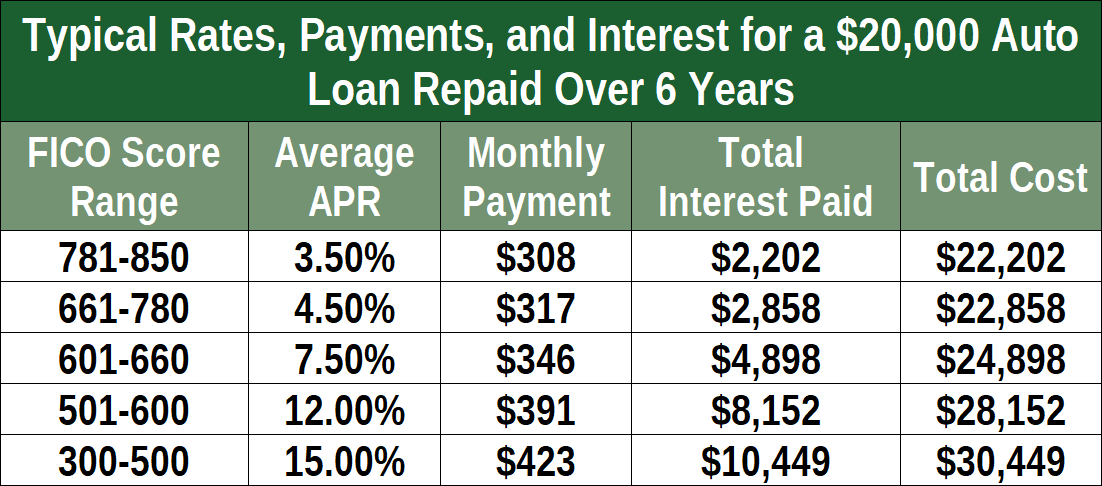

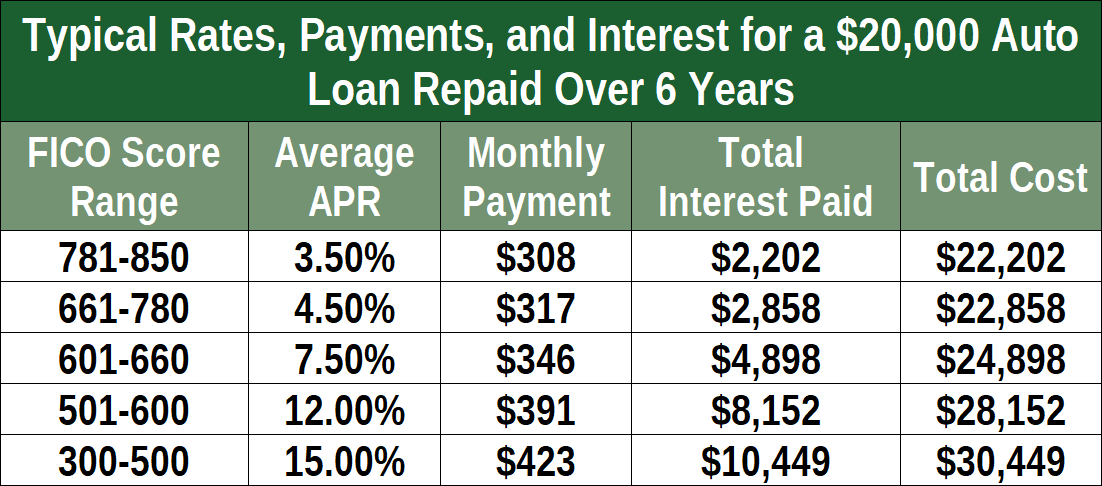

While interest rates vary based on several factors, including the lender, the vehicle you’re financing, and your location, we’ve compiled some sample rates from different lenders to give you an idea of what to expect.

As you can see, interest rates can range from around 10% to as high as 20% for a 48-month loan term. While a higher interest rate will result in higher monthly payments, it’s important to remember that the longer the loan term, the more you’ll pay in interest over time. So, if possible, opt for a shorter loan term to save money in the long run.

How to Improve Your Chances of Getting a Good Rate

While a low credit score can make it more challenging to qualify for a car loan with a low interest rate, there are a few things you can do to improve your chances:

- Shop around for the best rate: Don’t settle for the first loan offer you receive. Instead, compare rates from multiple lenders to find the best possible rate.

- Consider a co-signer: If you have a friend or family member with good credit who is willing to co-sign on your loan, it could help you qualify for a lower interest rate.

- Pay down debt: The less debt you have, the more likely you are to qualify for a better interest rate.

- Save for a down payment: The more money you can put down upfront, the less risky you appear to lenders, which can translate to a lower interest rate.

How to Apply for a Car Loan

Applying for a car loan is a straightforward process, but it’s important to do your research beforehand to ensure you’re getting the best rate possible. Here’s what you’ll need to do:

- Check your credit score: Before applying for a loan, check your credit score to get an idea of what interest rate you can expect.

- Shop around for rates: As mentioned earlier, be sure to compare rates from multiple lenders to find the best possible rate.

- Gather necessary documents: To apply for a car loan, you’ll typically need to provide proof of income, proof of insurance, and other personal information.

- Fill out the application: Once you’ve chosen a lender, you’ll need to fill out their loan application. This will involve providing all of the necessary information and agreeing to the loan terms.

- Get approved: After submitting your application, the lender will review your information and either approve or deny your loan. If approved, you’ll then be able to finalize the loan terms and purchase your vehicle.

Auto Loans from Auburn Community FCU

If you’re located in Auburn, NY, one option for auto loans is Auburn Community FCU. They offer competitive rates and flexible terms to help you find the loan that’s right for you. Check out their current rates below:

As you can see, their rates are competitive and could be a great option for those with a credit score of 600 or lower.

In Conclusion

While a low credit score can make it more challenging to qualify for a car loan with a low interest rate, it’s not impossible. Remember to shop around for the best rate, consider a co-signer or down payment, and be prepared with all of the necessary documents when applying for a loan. With a little effort, you’ll be able to find a loan that works for you and get behind the wheel of your dream vehicle.

If you are searching about Average auto loan rates by credit score | Lexington Law you've came to the right web. We have 7 Images about Average auto loan rates by credit score | Lexington Law like Auto Loan Rates: Used, New, and Refinance | LendEDU, Average auto loan rates by credit score | Lexington Law and also Average auto loan rates by credit score | Lexington Law. Read more:

Average Auto Loan Rates By Credit Score | Lexington Law

www.lexingtonlaw.com

www.lexingtonlaw.com Credit Union Auto Loan Rates: Better Or Worse Than Banks? | FCU

findcreditunions.com

findcreditunions.com loan

Average Auto Loan Rates | Credit Repair

www.creditrepair.com

www.creditrepair.com loan credit rates auto car average score standards regarding disclosure editorial

Car Loan Rates - 10 Best Auto Loan Rates (Guide For 2020)

epicsidegigs.com

epicsidegigs.com loan rates car guide auto

Auto Loans Auburn, NY | Car Loans | Auburn Community FCU

www.auburnfcu.com

www.auburnfcu.com loans auto auburn loan rates affordable ny

Auto Loan Rates: Used, New, And Refinance | LendEDU

lendedu.com

lendedu.com loan lendedu rates auto

Car Loan Interest Rate For 600 Credit Score - Classic Car Walls

classiccarwalls.blogspot.com

classiccarwalls.blogspot.com approval dealerships lots

Auto loans auburn, ny. Car loan interest rate for 600 credit score. Loan lendedu rates auto

Post a Comment for "Ukfcu Auto Loan Rates"