When it comes to buying a car, there are many different factors to consider, including the make and model of the vehicle, its safety features, and of course, its price tag. However, one of the most important considerations for many car buyers is the auto loan rate they will be able to secure. After all, even a small difference in interest rates can add up to thousands of dollars over the life of a loan. That's why it's important to do your research and find the best auto loan rates available. When it comes to finding the best auto loan rates, there are a few different options available. One of the most common places to start is with your bank or credit union. Many financial institutions offer auto loans, and they may be able to offer lower interest rates to their customers than they would to someone who is not already a member. Additionally, many banks and credit unions offer pre-approval for auto loans, which can help streamline the car-buying process and make it easier to negotiate with dealers. Another option for finding the best auto loan rates is to shop around with different lenders. This can include online lenders, traditional banks, credit unions, and even car dealerships themselves. Each lender will have different criteria for determining your interest rate, so it's important to get quotes from multiple sources and compare them carefully. Additionally, keep in mind that some lenders may offer incentives like cashback or rate reductions for factors like having a good credit score or setting up automatic payments. Once you've identified some potential lenders and received quotes for auto loan rates, it's time to start comparing them in more detail. One of the most important factors to consider is the interest rate itself, as this will determine how much you pay each month and over the life of the loan. However, there are other factors to keep in mind as well, such as the length of the loan term, any fees or penalties associated with pre-payment, and any additional perks or benefits that may be offered. Ultimately, the best auto loan rate will depend on your individual financial situation, as well as the type of vehicle you are looking to purchase. That being said, taking the time to research and compare auto loan rates can help you save money in the long run and make the car-buying process as smooth as possible. So whether you're in the market for a brand new luxury vehicle or a reliable used car, be sure to consider all of your options and find the best auto loan rate for your needs and budget. When it comes to securing an auto loan, credit unions can often offer many benefits and advantages over traditional banks. For starters, credit unions are not-for-profit organizations, which means that any profits they earn are used to benefit their members in the form of better interest rates and lower fees. Additionally, credit unions are often community-based, which means that they are more invested in the success of their members and may be more willing to work with them on finding the best loan options. While credit unions can offer many advantages, it's important to keep in mind that they may have stricter eligibility criteria than traditional banks. For example, many credit unions require that you be a member of a certain community or profession in order to join. Additionally, credit unions may not offer the same range of financial products and services as traditional banks, so it's important to do your research and make sure that a credit union is the right choice for you. If you do decide to go with a credit union for your auto loan, there are a few tips to keep in mind. First and foremost, make sure that you are eligible for membership and that you understand the requirements and benefits of membership. Additionally, be prepared to provide detailed financial information and documentation in order to apply for a loan. Finally, make sure that you compare the auto loan rates offered by different credit unions, as well as traditional banks and online lenders, in order to find the best deal for your needs and budget. In conclusion, when it comes to finding the best auto loan rates, there are a variety of options available, including traditional banks, online lenders, and credit unions. By shopping around and comparing rates, terms, and benefits, you can find the best loan option for your individual needs and budget. Whether you're in the market for a brand new car or a reliable used vehicle, taking the time to research and compare auto loan rates can help you save money and make the car-buying process as smooth as possible.  www.csecreditunion.com

www.csecreditunion.com  www.sappscarpetcare.com

www.sappscarpetcare.com  epicsidegigs.com

epicsidegigs.com  lendedu.com

lendedu.com  kansascitycreditunion.com

kansascitycreditunion.com  classiccarwalls.blogspot.com

classiccarwalls.blogspot.com  secny.org

secny.org

If you are searching about CSE Credit Union - Loan Rates you've visit to the right place. We have 7 Images about CSE Credit Union - Loan Rates like CSE Credit Union - Loan Rates, Auto Loan Rates: Used, New, and Refinance | LendEDU and also CSE Credit Union - Loan Rates. Here it is:

CSE Credit Union - Loan Rates

www.csecreditunion.com

www.csecreditunion.com Current Auto Loan Rates Utah

www.sappscarpetcare.com

www.sappscarpetcare.com rates current auto loan utah

Car Loan Rates - 10 Best Auto Loan Rates (Guide For 2020)

epicsidegigs.com

epicsidegigs.com loan rates car guide auto

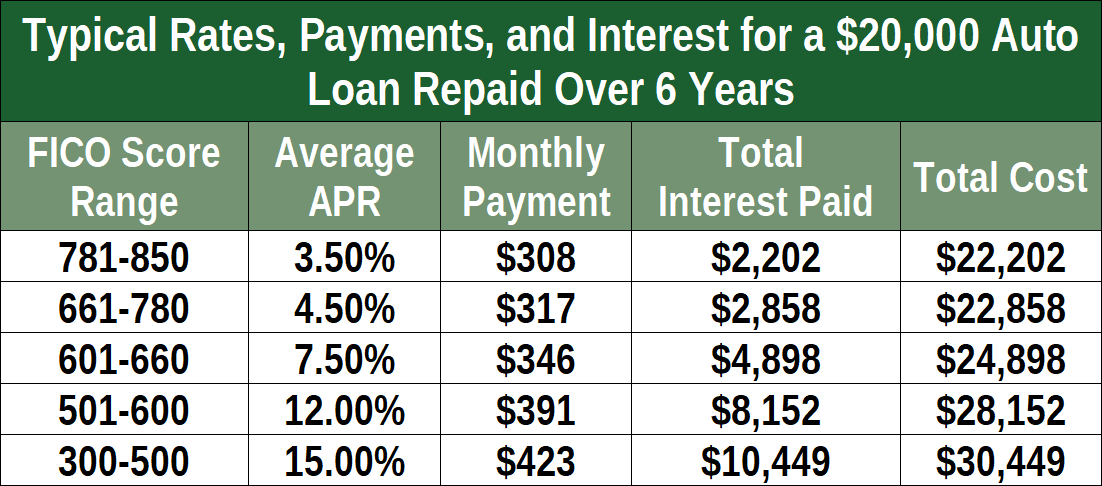

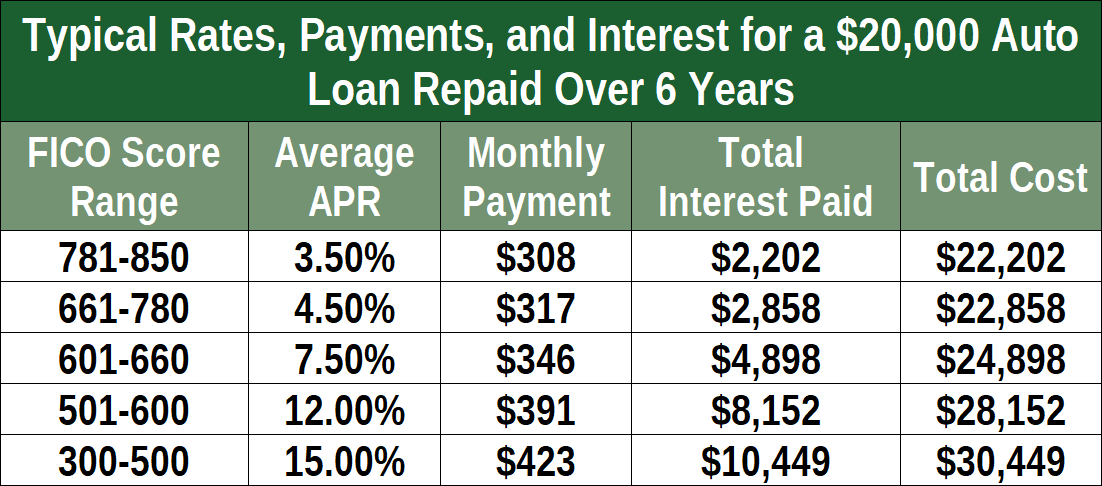

Auto Loan Rates: Used, New, And Refinance | LendEDU

lendedu.com

lendedu.com loan lendedu rates auto

5 Benefits Of Securing A Car Loan From A Credit Union - Kansas City

kansascitycreditunion.com

kansascitycreditunion.com securing interest

Car Loan Interest Rate For 600 Credit Score - Classic Car Walls

classiccarwalls.blogspot.com

classiccarwalls.blogspot.com approval dealerships lots

Best Mortgage Rates In CNY | Syracuse Federal Credit Union | SECNY

secny.org

secny.org rates loan auto personal mortgage syracuse credit

Best mortgage rates in cny. Loan rates car guide auto. Rates loan auto personal mortgage syracuse credit

Post a Comment for "Cse Auto Loan Rates"