Hey y'all,

Need cash? PEP Loans might be the answer

Have you ever found yourself in a tight spot financially, with no idea where to turn? It happens to the best of us, and thankfully, PEP Loans is there to lend a helping hand when you need it most. But let's be real, the interest and fees can be confusing. Let me break it down for you.

Understanding the interest and fees

When you apply for a loan from PEP Loans, you'll need to keep in mind the interest and fees associated with it. These can vary depending on the amount you borrow and the length of time it will take you to pay it back. It's important to read all the fine print associated with your loan to ensure you fully understand what you're signing up for.

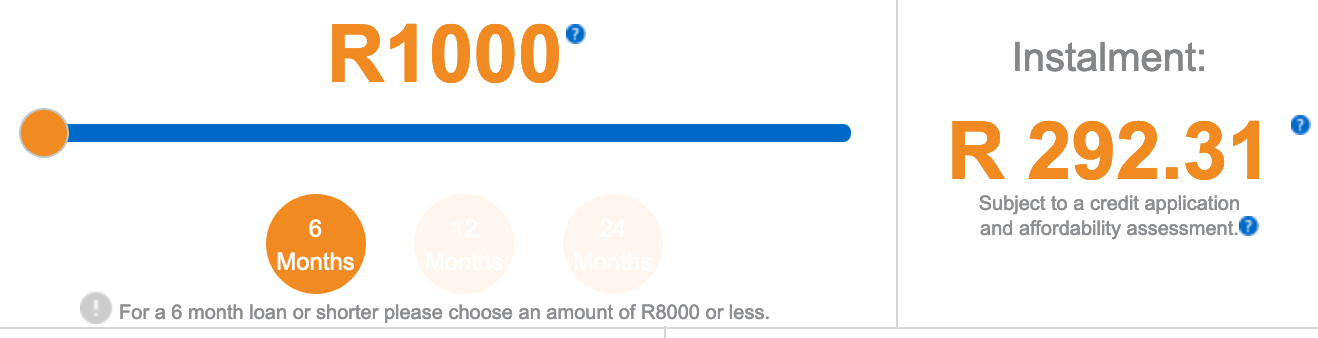

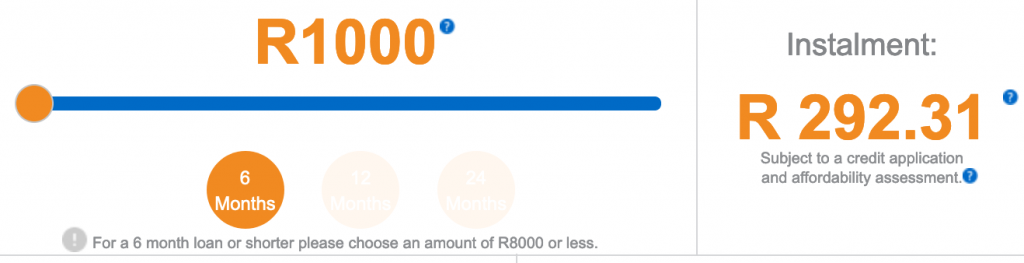

For example, for a loan between R500 and R1,500, you can expect to pay an initiation fee of R165, along with a monthly service fee of R60. The interest rate is fixed at 5% per month. So, if you borrow R1,000 for 6 months, you'll end up paying back R1,920 in total. While these fees may seem steep, they can be a lifesaver in times of need.

Applying for a PEP Loan

If you're interested in applying for a loan from PEP Loans, the process is fairly simple. You can head to your nearest PEP store and speak with a consultant about your options. You'll need to bring along a few documents, including your ID, proof of income, and proof of residence. Alternatively, you can apply online by visiting the PEP Loans website.

PEP Loans for the blacklisted

If you're blacklisted, don't despair. PEP Loans is still an option for you. While they may do a credit check as part of the application process, they take into consideration your current financial situation as well. This means that even if you have a less-than-spotless credit history, you may still be eligible for a loan from PEP Loans.

However, it's important to note that taking out a loan when you're already struggling financially can be risky. It's important to make sure you'll be able to pay the loan back within the given time frame, or you may end up in an even worse situation.

The bottom line

PEP Loans can be a helpful option when you find yourself in need of some extra cash. Just make sure to fully understand the interest and fees associated with your loan, and to only take out what you can realistically afford to pay back. And always remember, there's no shame in asking for help when you need it.

Take care, y'all!

If you are searching about Capfin SA Loans Application Online - The Money Mall you've came to the right page. We have 7 Pictures about Capfin SA Loans Application Online - The Money Mall like Pep loans for blacklisted 2022 | Loanspot, PEP Loans For Blacklisted in Sep 2, 2021:Apply Here - FineHelp and also PEP Loans For Blacklisted in Sep 2, 2021:Apply Here - FineHelp. Here it is:

Capfin SA Loans Application Online - The Money Mall

www.moneymall.co.za

www.moneymall.co.za capfin

Pep Loans For Blacklisted 2022 | Loanspot

loanspot.io

loanspot.io Capfin SA Loans Application Online - The Money Mall

www.moneymall.co.za

www.moneymall.co.za capfin

PEP Loans Interest And Fees | How To Apply For A PEP Loan

www.mufudza.co.za

www.mufudza.co.za pep

Pep Loans For Blacklisted 2022 | Loanspot

loanspot.io

loanspot.io PEP Loans For Blacklisted In Sep 2, 2021:Apply Here - FineHelp

finehelp.co.za

finehelp.co.za blacklisted pep

How To Apply For PEP Loans For Blacklisted In South Africa - Italkloans

italkloans.co.za

italkloans.co.za Pep loans for blacklisted in sep 2, 2021:apply here. Pep loans interest and fees. Pep loans for blacklisted 2022

Post a Comment for "Pep Loans For Blacklisted"